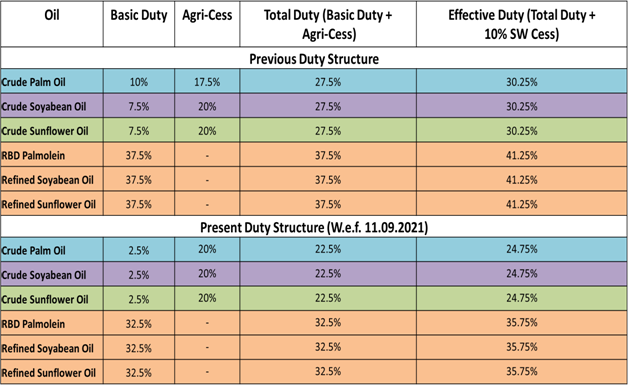

In order to reduce edible oil prices, Centre reduces the standard rate of duty on Crude Palm Oil, Crude Soyabean oil and Crude Sunflower Oil to 2.5%

Standard rate of duty on Refined Palm Oils, Refined Soyabean oil and Refined Sunflower Oil reduced to 32.5%

Direct value of benefits expected to be passed on to the consumers, in terms of duties given up by Government, is Rs 4600 crore

In order to ensure availability of edible oil to consumers at fair prices, Government of India, vide Notification No. 42/2021- Customs, dated 10th September 2021, has further reduced the standard rate of duty on Crude Palm Oil, Crude Soyabean oil and (i) Crude Sunflower Oil to 2.5% with effect from 11.09.2021 and (ii) the standard rate of duty on Refined Palm Oils, Refined Soyabean oil and Refined Sunflower Oil to 32.5% with effect from 11.09.2021.

In the same notification the Agri-cess for Crude Palm Oil has been increased from 17.5% to 20%.

The Government, Vide Notification No. 43/2021-Customs, dated 10th September 2021 has rescinded the notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 34/2021- Customs, dated the 29th of June, 2021, except as respects things done or omitted to be done before such rescission meaning thereby the latest import duty (w.e.f. 11.09.2021) stand still till further orders.

It may be noted that the International prices and thereby domestic prices of edible oils have been ruling high during 2021-22 which is a cause of serious concern from inflation as well as consumer’s point of view. Import duty on edible oils is one of the important factors that impacted landed cost of edible oils and thereby domestic prices.

In order to mitigate the rise in these prices, Government of India had taken series of steps between February 2021 and August 2021.Some of them included-

- Rationalization of Import Duty

• The Government, Vide Notification No. 34/2021- Customs, dated 29thJune, 2021, has reduced the standard rate of duty on Crude Palm Oil to 10% from 30.06.2021 and will have effect upto 30th September, 2021.

2) The Government, vide DGFT’s Notification No. 10/2015-2020 dated 30th June, 2021, has amended the import policy of Refined Palm Oils from “restricted” to “free” with immediate effect and for a period of upto 31.12.2021.

Further, the refined Palm Oils is not permitted through any port in Kerala.

3) The Government, Vide Notification No. 40/2021- Customs, 19th August, 2021, has reduced the standard rate of Duty on Crude Soyabean Oil and Crude Sunflower Oil to 7.5% and Refined Soyabean Oil and Sunflower oil to 37.5% with effect from 20.08.2021. It has been done through the amendments in the notification of the Government of India, in the Ministry of Finance (Department of Revenue) No. 34/2021-Cutoms, dated 29th June, 2021

4) Facilitation at various port by Customs, FSSAI, PP&Q, DFPD and DoCA

5) To speed up clearances of consignments of imported edible oils delayed due to COVID-19, a Committee is in place comprising of Food Safety & Standards Authority of India (FSSAI), Plant Quarantine of the D/o Agriculture, Cooperation & Farmers Welfare, D/o Food and Public Distribution, D/o Consumer Affairs and Customs which reviews the consignments of imported edible oils on weekly basis and also apprises the Inter-Ministerial Committee on Agricultural Commodities chaired by Secretary (Food).

The Standard Operating Procedure for faster clearance of consignments of imports of edible oils have been prepared. The average dwell time for clearances of consignments has come down to 3.4 days in case of edible oils.

As per the latest notification the previous and present Import duties is tabulated below:

The duty cuts already made amount to an estimated Rs.3500 crore in a full year. With the current/latest reduced import duty worth Rs.1100 crore in full year, total direct value of benefits expected to be passed on to the consumers, in terms of duties given up by Government, is Rs 4600 crore .